What is an EMI?

EMI stands for Equated Monthly Instalment which is a fixed amount of payment a borrower has to make to the lender at a specified date on monthly basis. EMIs consists of your principal loan amount and interest amount, payable every month.

Although the EMI remains fixed for every month, the amount paid towards principal and interest changes. The interest component constitutes a major portion of the EMI payment in the initial stages. However, as the loan period progresses and the principal outstanding reduces, the portion of interest repayment decreases. This happens until the end of the loan period when the entire loan amount has been paid off.

How EMI Calculators Work?

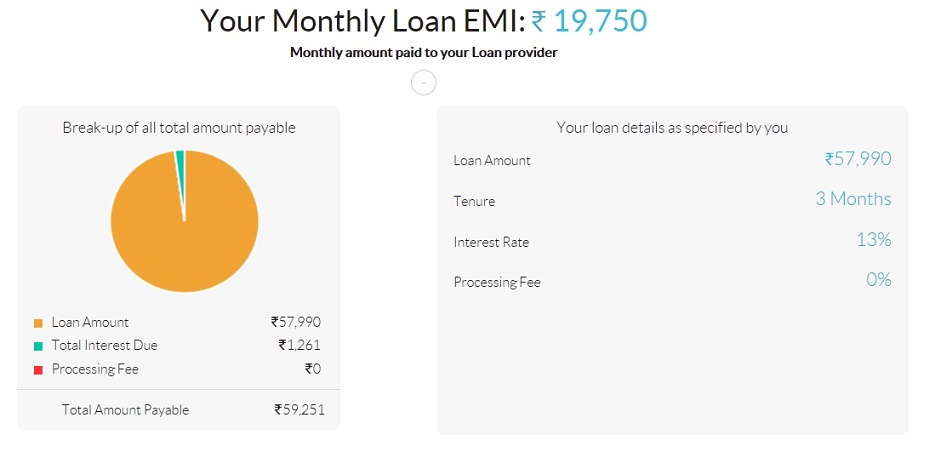

To put it quite simply, an EMI calculator is a tool that will require you to enter the amount you want to borrow, the duration of the loan, the interest rates and the processing fee and it will do the rest. The basic formula that works behind an EMI calculator is:

E = P x r x (1+r)^n/((1+r)^n – 1)

Here:

E is the amount that you will have to pay every month; basically the EMI.

P is the amount that you want to borrow.

r is the rate of interest that is applicable but calculated on a monthly basis instead of the annual rate of interest. It is obtained by using the formula r = (annual interest/12) x 100.

n is the duration of the loan in terms of months. So if you select a term of 3 years, n will be 36.

Calculating the EMI for your loan is crucial to determine whether it matches your repayment capability or not. Applying for a loan that exceeds your ability to repay the debt can lead to the rejection of your application. If you apply for a loan wherein the EMI is equal to your maximum repayment ability, your chances of defaulting severely increases. In case you are not able to check your EMI using an online EMI calculator, you can also do the same using an Excel spreadsheet. All you need to do is use the PMT function to calculate your monthly installments.

The syntax for the excel function is:

PMT (rate, nper, pv)

PMT(0.01083333, 3, 57990)

PMT(0.01083333, 3, 57990)

Here,

pv = The principal amount or the present value

rate = The fixed rate of interest at which the loan is borrowed

nper = The number of payments to be made to repay the entire debt

How Are EMIs Calculated?

The mathematical formula for calculating EMI = [P x R x (1+R) ^n] / [(1+R)^ n-1]. (P is the principal loan amount, R rate of interest per month and N is the the number of monthly instalments).

🔻