History:-

In March 1943, B. P. Adarkar was appointed by the Government of India to create a report on the health insurance scheme for industrial workers. The report became the basis for the Employment State Insurance (ESI) Act of 1948. The promulgation of Employees’ State Insurance Act, 1948 envisaged an integrated need based social insurance scheme that would protect the interest of workers in contingencies such as sickness, maternity, temporary or permanent physical disablement, death due to employment injury resulting in loss of wages or earning capacity. The Act also guarantees reasonably good medical care to workers and their immediate dependents. Following the promulgation of the ESI Act the Central Govt. set up the ESI Corporation to administer the Scheme. The Scheme thereafter was first implemented at Kanpur and Delhi on 24 February 1952. The Act further absolved the employers of their obligations under the Maternity Benefit Act, 1961 and Workmen’s Compensation Act 1923. The benefits provided to the employees under the Act are also in conformity with ILO conventions.

Employees’ State Insurance Scheme

ESI scheme is a contributory fund that enables Indian employees to take advantage of self-financing and healthcare insurance fund contributed by the employee and the employer. The scheme is managed by Employees’ State Insurance Corporation which is a self- financing social security and labor welfare organization. It administers and regulates ESI scheme as per the rules mentioned in the Indian ESI Act of 1948.

ESI is one of the most popular integrated need-based social insurance schemes among employees that protects their interest in uncertain events, such as temporary or permanent physical disability, sickness, maternity, injury during employment, and more.

Eligibility For ESI Deduction

ESI scheme applies to all establishments, like corporate organizations, factories, restaurants, cinema theatres, offices, medical and other institutions which are located in the scheme-implemented areas, where 10 or more people are employed. All employees of a covered unit, whose monthly incomes (excluding overtime, bonus, leave encashment) does not exceed Rs. 21,000 per month, are eligible to avail benefits under the Scheme. ESI fund provides cash and medical benefits to employees and their immediate dependents.

ESI deduction is calculated on an employee’s gross pay. Most of the employees face confusion in understanding ESI deduction rules because they aren’t clear with the concept of Gross Salary amount.

Gross salary is described as the total income earned while working in a job, before any deductions made for health insurance, social security and state or federal taxes.

For ESI calculation, the salary comprises of all the monthly payable amounts such as basic pay, dearness allowance, city compensatory allowance, HRA, incentive allowance, attendance bonus, meal allowance and special allowance. The salary, however, does not include annual bonus, retrenchment compensation, encashment of leave and gratuity.

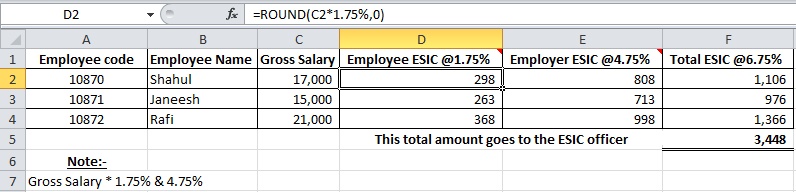

The contributions under the ESI Scheme is raised from the employees & employers. The rates of contribution, as a percentage of wages payable to the employees are:

Employees’ contribution 1.75% of the gross pay

Employers’ contribution 4.75% of the gross pay

Thus, 6.50% of the wages is to be paid as contribution to Scheme for each worker.

ESI Calculation

Consider the gross salary of an employee is Rs. 12,000 per month then the ESI calculation for the employee would be calculated as:

ESI = 12,000*(1.75/100) = 210

(Employees contribution is 1.75 percent)

The ESI calculation for the employer’s contribution would be calculated as:

12,000*(4.75/100) = 570

(Employer’s contribution is 4.75 percent)

In case, the salary goes above Rs. 21,000 per month during the contribution period (as defined below), the ESI would be calculated on the higher salary. For example, if the salary of an employee is raised to Rs. 25,000 per month during the ESI contribution period, then the ESI would be calculated on Rs. 25,000 instead of Rs. 21,000.

🔻